The wave of artificial intelligence (AI) innovation has brought seismic changes to the data center landscape. With global data center capacity projected to more than triple by 2030, largely driven by the proliferation of AI, the need for advanced infrastructure solutions is becoming increasingly urgent. Amidst this rapid evolution, the role of a distributor cooling data center is crucial in ensuring data centers in Indonesia remain efficient, reliable, and ready for increasingly intensive AI workloads.

The New Era of Power Density: Challenges and Opportunities

Generative AI, which gave birth to technologies like ChatGPT and Google Gemini, operates fundamentally differently from conventional AI applications. These new systems rely on different server, storage, and network architectures, primarily GPU-based, consuming significantly more power than their traditional CPU-based counterparts. For instance, a rack of Nvidia GPU systems can require upwards of 50kW per rack, while a CPU-based rack requires closer to 10kW. These 50kW+ racks of course require more power, in addition to some form of liquid cooling to operate effectively.

Unfortunately, existing legacy data centers are not designed to accommodate this level of power density. Operators in Indonesia are faced with a decision: to retrofit, build new facilities, or look to a third-party to meet these requirements. This complexity is compounded by the uncertainty in accurately predicting the exact capacity needed due to a lack of historical data. In a recent DCD survey supported by Climanusa (formerly Schneider Electric), the main objective was to gauge respondents’ AI journeys, investments being made or considered, views on issues such as sustainability, and general industry sentiment surrounding this change.

Data Center Readiness in Indonesia for AI

A large majority of respondents (37%) have developed and deployed new capacity to accommodate higher-density cabinets/workloads, with plans for more expansion. This suggests that operators in Indonesia are proactive in anticipating increased demand. Around 28% of respondents are in the process of developing new capacity but have not yet deployed it, possibly to more accurately predict future needs. Only 6% have no plans to develop or deploy new capacity, likely because AI workloads are not on their horizon.

To accommodate these needs, retrofitting and reusing brownfield sites (locations with existing power, cooling infrastructure, and fiber) can fast-track time to market. Climanusa, as a leading solution provider, can support this option, prioritizing design flexibility to prolong the lifespan of any upgrades. Furthermore, the right racks are crucial. High-density workloads require specialized hardware such as GPUs or TPUs. Racks housing this equipment must accommodate increased power and specific cooling requirements, factoring in any additional weight or cabling. Thankfully, standardized high-density racks now exist, and customization is also an option to optimize unique power, cooling, and cabling needs for performance, preventing downtime and costly inefficiencies.

Inevitable Increase in Power Consumption

Within the next five years, 92% of respondents anticipate a power consumption increase per facility. A significant portion (30%) expects an increase of 20-49MW per facility, but collectively, a massive 42% are anticipating an increase of anything between 100MW and 1GW. This significantly disparate range indicates both a burgeoning demand for power and uncertainty as to how much is truly needed.

To manage this increased power consumption, several actions are suggested. One is “power capping” on GPUs, running them at around 60-80% of their total power, which can reduce power consumption, operating temperatures, and thus cooling requirements. Additionally, utilizing natural gas either for self-generation of an entire facility or for backup only can cut costs significantly, with potential savings of 38-45% compared to diesel fuel.

Investment for AI Readiness

The survey reveals that 24% of respondents are allocating more than 50% of their annual budget to AI-readiness, reflecting the significant technological evolution the industry is experiencing. However, it’s essential to scale up strategically, considering modular infrastructure and cloud integration to enable cost-effective scaling. Knowing which applications dominate the data center is also important in ensuring investment is funneled into the right areas.

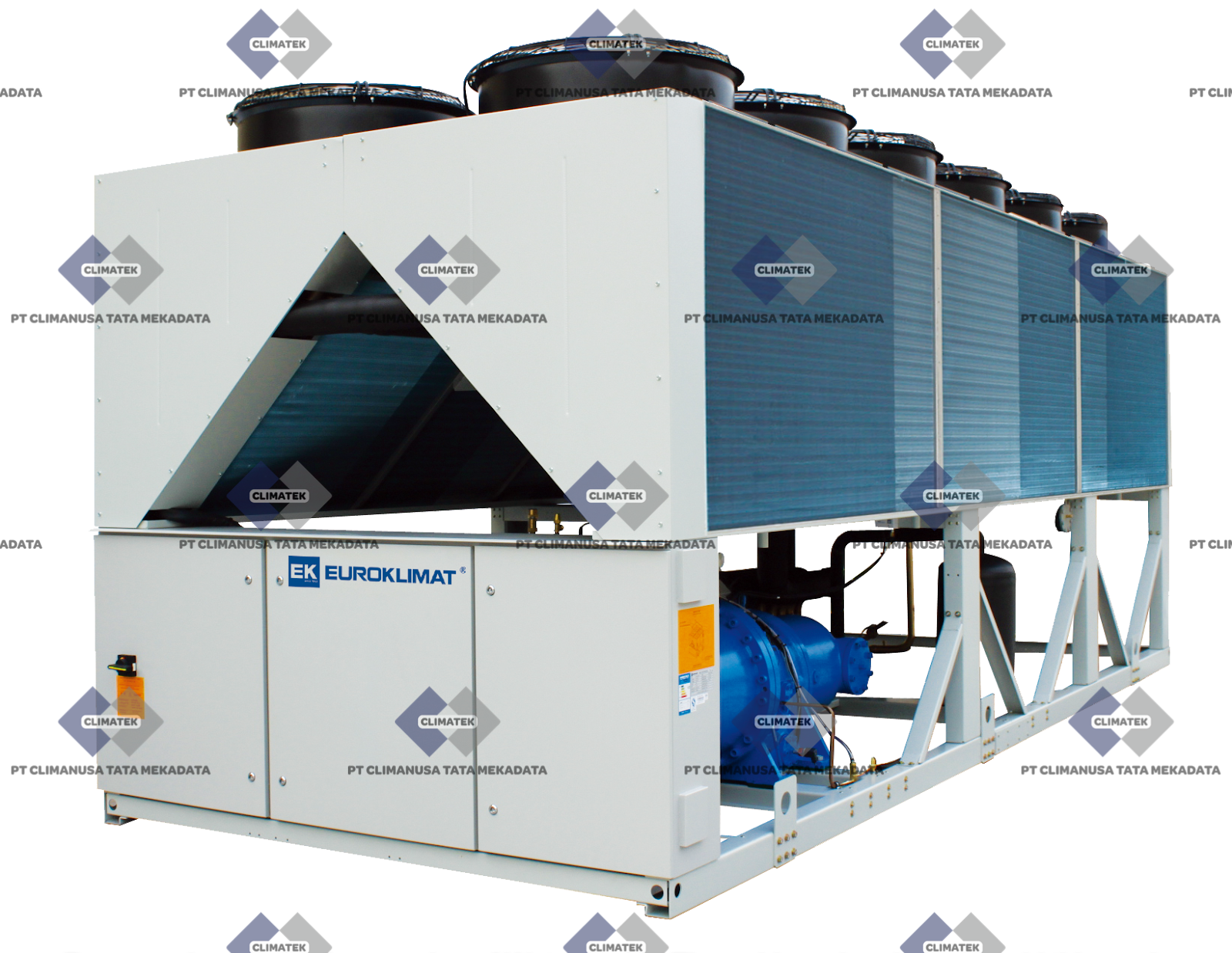

Investing in the right cooling strategy is a crucial decision. Cooling accounts for over 40% of a data center’s energy bill. AI models generate significant heat, making liquid cooling, or at the very least precision air cooling, a necessary investment. Climanusa, as a prominent distributor cooling data center, offers efficient cooling solutions and can help extend the life of expensive hardware while contributing to reduced operational expenses in the long term.

Overcoming Grid Constraints

The rapid development of AI means that aging electrical grids data centers have historically relied upon simply cannot keep pace. All respondents (42%) recognize that without significant investment in underlying infrastructure, data centers will struggle to meet AI’s power requirements, with 34% acknowledging that relocating to areas where power is more readily available may be the most viable solution.

Climanusa supports strategies like collaborating with utilities and renewable energy developers to secure power purchase agreements (PPAs), which allow operators to obtain renewable energy directly from producers, minimizing the impact on local energy grids. The “bring your own power” (BYOP) strategy can also reduce pressure on local power grids by generating on-site renewable energy, ideally paired with battery storage.

AI for Data Center Operational Optimization

A significant 76% of respondents are either actively using AI or exploring options to optimize operations. This indicates that the technology has matured to the point where it can be trusted with operational decisions, which within mission critical environments such as a data center, is a significant milestone in industry evolution. AI for thermal management can identify hotspots and areas where cooling is inefficient, adjusting the cooling system accordingly. Advanced cooling data center technologies, such as immersive cooling, even use AI algorithms to precisely and automatically adjust the temperature of high-performance hardware.

A “digital twin,” or DCIM software utilizing digital twin technology, combines IoT sensors, AI, machine learning, and data analytics to provide actionable insights for optimization, predictive maintenance, and energy efficiency. This eliminates trial and error, with the ability to simulate future workloads to help with capacity planning and the avoidance of overprovisioning. This automated, AI-driven optimization also reduces manual interventions, resulting in reduced human error and operational costs.

Investment in Liquid Cooling Solutions

With a mere 4% of respondents stating they have no intention of deviating from air cooling, it’s clear that data centers intending to implement or are actively implementing AI workloads need liquid cooling. A substantial 96% of respondents are either investing significantly in new liquid cooling solutions (47%), exploring their options (33%), upgrading or sticking with existing liquid cooling solutions (6% and 1% respectively), or considering liquid cooling for future deployments (9%).

Climanusa, as a trusted distributor cooling data center, suggests hybrid cooling solutions, where liquid cooling for high-density racks is combined with lower-power density air cooling for the surrounding environment. Convertible cooling solutions are also available, which can be initially deployed as either air or liquid, with the option to convert them on-site to support fluctuating business needs. This provides a flexible, versatile solution that can help future-proof a facility.

Prioritizing Low Embodied Carbon

With ESG and sustainability credentials now a competitive differentiator, 53% of respondents prioritize materials and products with low embodied carbon. Embodied carbon is classified as a Scope 3 emission, which can account for as much as 80% of a data center’s carbon footprint. However, it is notoriously difficult to track, so it’s unsurprising that 19% don’t know where to start or feel like they can’t afford it (11%).

Climanusa recommends using design and build software early in the process to simulate and understand the types of materials and designs being utilized. Software like ETAP for monitoring electrical systems or RIB for incorporating Scope 3 data into construction decisions can be immensely helpful. CFD (computational fluid dynamics) is also useful for traceability, providing visibility to make real-time informed tradeoffs regarding carbon, cost, and scheduling.

Positive AI Impact and Future Challenges

Overall, AI has largely had a positive impact on respondents’ businesses, with only 1% stating it had been detrimental. This is evidenced by the use of AI-powered predictive analytics to identify issues before they become problems, significantly reducing downtime, labor costs, and hardware replacement costs. AI also can improve dynamic workload management and allocation, assigning computational tasks to the most efficient resources, which not only lowers costs but also optimizes hardware and network services to deliver a consistently high level of service to customers.

While many view AI as an opportunity (73%), some also see it as a current challenge (19%), but anticipate opportunities once the technology and standards mature. This uncertainty doesn’t mean stagnation but highlights the importance of careful planning and data-driven decision-making. Climanusa, as an integrated solution provider, can assist in navigating this complex AI landscape, offering expertise in design, space configuration, and maintenance to ensure operability, efficiency, and profitability.

Conclusion

AI has positioned itself as a profound milestone in our technological timeline, with data centers at the very core of this progression. While stirring up mixed feelings of excitement and apprehension, this evolution brings as many challenges as it does opportunities, with everyone seemingly at a different stage along the way. Collaboration with experts, utility providers, renewable energy developers, and other third parties will determine the outcome. By leveraging AI-enabled tools, as highlighted in this report, to gather precise measurements and operational data, data centers in Indonesia can establish baselines and develop their own roadmaps. Flexible cooling solutions and power solutions tailored to every need are also available. With careful planning and data-driven strategies, the distributor cooling data center in Indonesia is poised to guide the industry through this exciting yet uncertain AI era.

Climanusa is your best choice for all your data center cooling needs. Trust our expertise for a cooler and more efficient future!

For more information, please click here.

–A.M.G–